Sri Lanka retains most diversified island economy crown

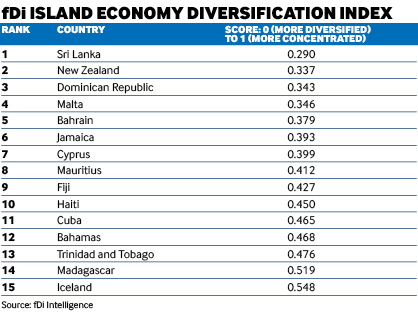

The second annual fDi Diversification Index for Island Economies has again determined those locations that have the most diversified greenfield foreign investment portfolio. Sri Lanka and New Zealand remain in the top spots, while the Dominican Republic rises to third place. Cathy Mullan reports.

Sri Lanka has retained the title of fDi’s most diversified island economy for 2017, with a score of 0.290. Between 2003 and 2016, the country attracted FDI projects across 35 sectors, according to data from greenfield investment monitor fDi Markets.

Financial services was the biggest sector for investment in Sri Lanka in the period analysed, attracting 75 projects, or just over one-fifth of Sri Lanka’s total investment. Germany-based insurance and asset management company Allianz invested 29 times in the country, as part of an expansion strategy for the company’s branch network.

The country received 30 projects in each of the business services and transportation sectors in that time. In May 2016, Japan-based logistics company Nippon Express opened an office in the capital, Colombo, to serve the local market, and attributed its investment decision to the increased level of investment in infrastructure.

This comes on the back of a deal agreed in 2004, when Sri Lankan authorities partnered with the World Bank to develop the national and rural network of roads as part of the bank’s Road Sector Assistance Project, aiming to increase connectivity, improve social integration and further economic development. The resulting infrastructure improvements not only attracted investors across a variety of sectors and reduced transportation costs, but also increased the percentage of families with access to an ‘all weather’ road from 48.3% to 70.9% in 2016.

New Zealand has remained in second place in the diversification rankings, scoring 0.337. Its FDI spans 35 sectors, with a focus on business services and software and IT investments, which totalled 98 and 94 projects, respectively.

The Dominican Republic has displaced Malta to rank third this year, scoring 0.343 and landing 191 projects over 26 sectors between 2003 and 2016. More than 15% of the country’s total investment in that time was in the hotels and tourism sector, followed by business services (13.6%) and financial services (12.6%).

Meanwhile, Iceland is still the study’s most specialised economy, with a score of 0.548 (the higher the score, the more specialised the economy). It received 25 projects over 11 sectors between 2003 and 2016, most of which were in the metals sector.

US-based Silicor Materials has established a manufacturing facility in Iceland, crediting the country’s world-class manufacturing and transportation infrastructure for its decision, as well as its ranking among the world’s top aluminium producers.

Methodology

To generate the list of island economies to be assessed we first set some parameters:

- a population of less than 25 million people;

- a GDP per capita purchasing power parity of less than $50,000;

- a minimum of 20 greenfield FDI projects recorded between 2003 and 2016.

The index is created based on the Hirschman Index (the most widely used measure of trade and commodity concentration) using the following formula:

- the formula is adapted to focus on FDI rather than exports;

- where Xi is the FDI value of sector i and X is the country’s total FDI;

- the formula is run for both projects and capital investment and an average of the two scores is used to create the fDi Diversification Index score;

- the lower the score (H1), the more diversified an economy is; the higher the score the more specialised the economy is.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.